Don’t sweat the what-ifs.

Make your registration refundable.

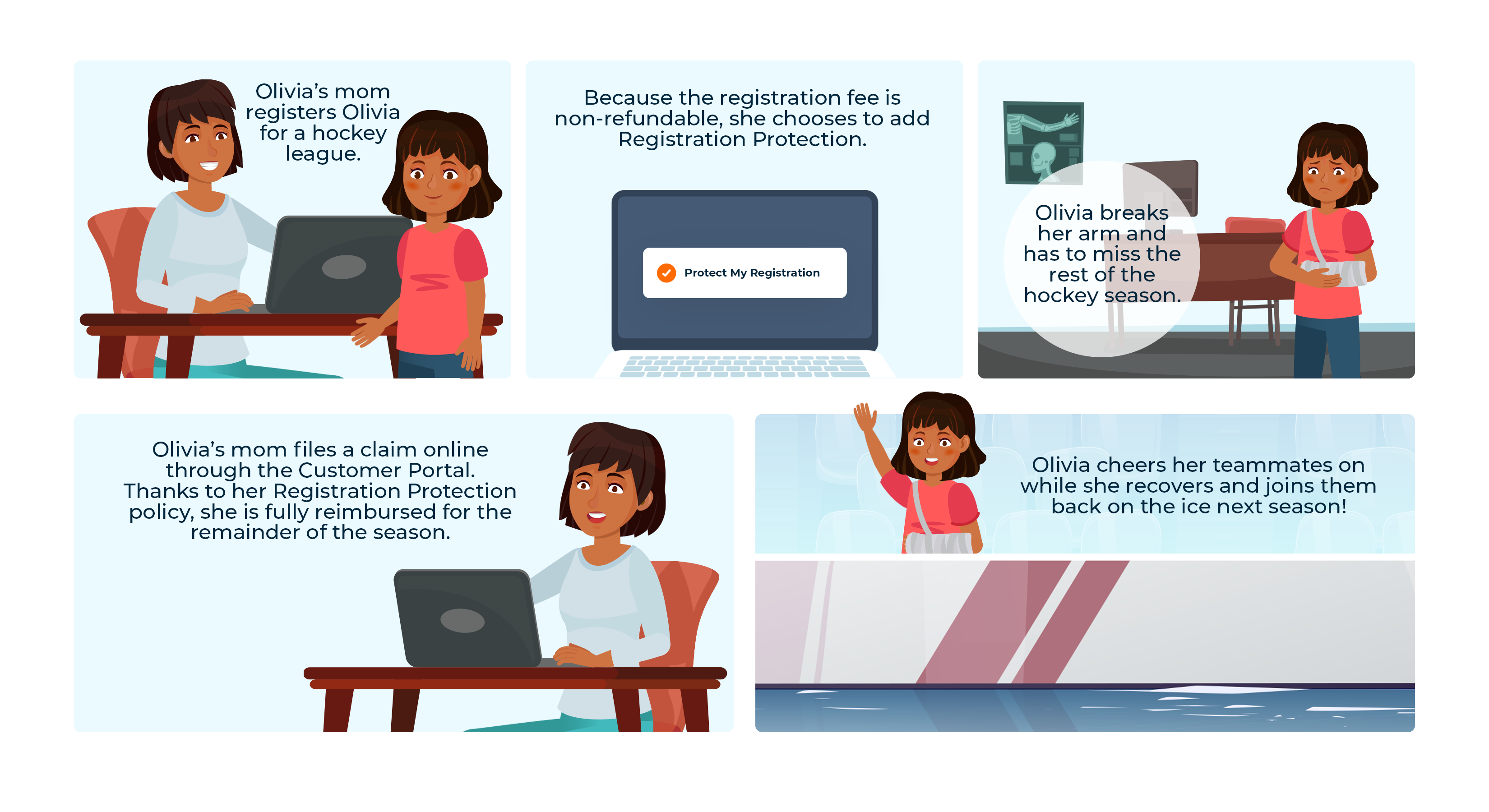

Life is unpredictable – yet registration fees are typically non-refundable and required far in advance. It’s often difficult for organizations to honor refund requests since fees are needed for basic operating costs. Refund Protection offers another solution by offering up to a 100% reimbursement if you’re unable to participate for a covered reason.

- The athlete is injured or ill and unable to complete the season or participate in the tournament or event

- A family member is hospitalized, preventing the athlete from participating

- Active military duty prevents the athlete from participating

- For tournaments and events: a traffic accident on the way to the event that prevents participation

- For tournaments and events: severe weather that prevents participation

What’s not covered:

- The athlete decides not to participate

- The athlete does not make the team

- Personal schedule conflicts

- The season, tournament, or event is cancelled

- Pre-existing medical conditionals

*Please refer to your policy for a detailed list of covered perils.

How It Works

Frequently Asked Questions

What is covered by Refund Protection?

Covered reasons for reimbursement can include injuries, illnesses, inclement weather, traffic accidents, and so much more. Please refer to your policy for a full list of covered perils.

How does Refund Protection work?

Registration fees for sports and activities are typically non-refundable. Refund Protection provides a reimbursement for families if a registered participant is forced to withdraw for a covered reason.

How long am I covered?

Coverage starts the day after the policy is purchased. You are eligible to file a claim if a covered peril occurs on or after the first day of coverage or at any point during the season.

What if I withdraw halfway through the season?

If the covered reason occurred prior to start of the season, you are eligible for a full refund. If the reason for withdrawal occurs during the season, you will be provided a pro-rated reimbursement.

How do I file a claim?

After purchase, you can create a free account in our Customer Portal. The portal will display a full. list of your active policies and links to begin the claims process. Click here for instructions on how to create an account.

Can I cancel my policy?

If you are not satisfied with the product for any reason, you have the option to cancel your policy within ten (10) days of the initial purchase date – as long as you have not filed a claim. To cancel your policy, please contact us at support@verticalinsure.com.