Be prepared when accidents happen.

Extra coverage for high deductibles.

The average deductible for employer-provided health insurance is $2,700, with high-deductible plans averaging about $4,500. If an accident happens, you’re left paying that deductible out-of-pocket. And what if the injury occurs when you’re away from home and you visit an out-of-network medical provider?

Accident & Injury Insurance can fill that gap by reimbursing up to $5,000 to cover your deductible, copays, and coinsurance if you’re injured during the covered activity.

An Injury Without Accident Insurance:

Total bill for an ER Visit before insurance:

$6,000

Primary Health Insurance plan covers:

$2,800 (80% of total bill after the $2,500 deductible)

Final bill after insurance:

$2,500 deductible + $700 coinsurance

You pay out-of-pocket:

$3,200

An Injury With Accident Insurance:

Total bill for an ER Visit before insurance:

$6,000

Primary Health Insurance plan covers:

$2,800 (80% of total bill after the $2,500 deductible)

Accident Insurance covers:

$2,500 deductible + $700 coinsurance

You pay out-of-pocket:

$0

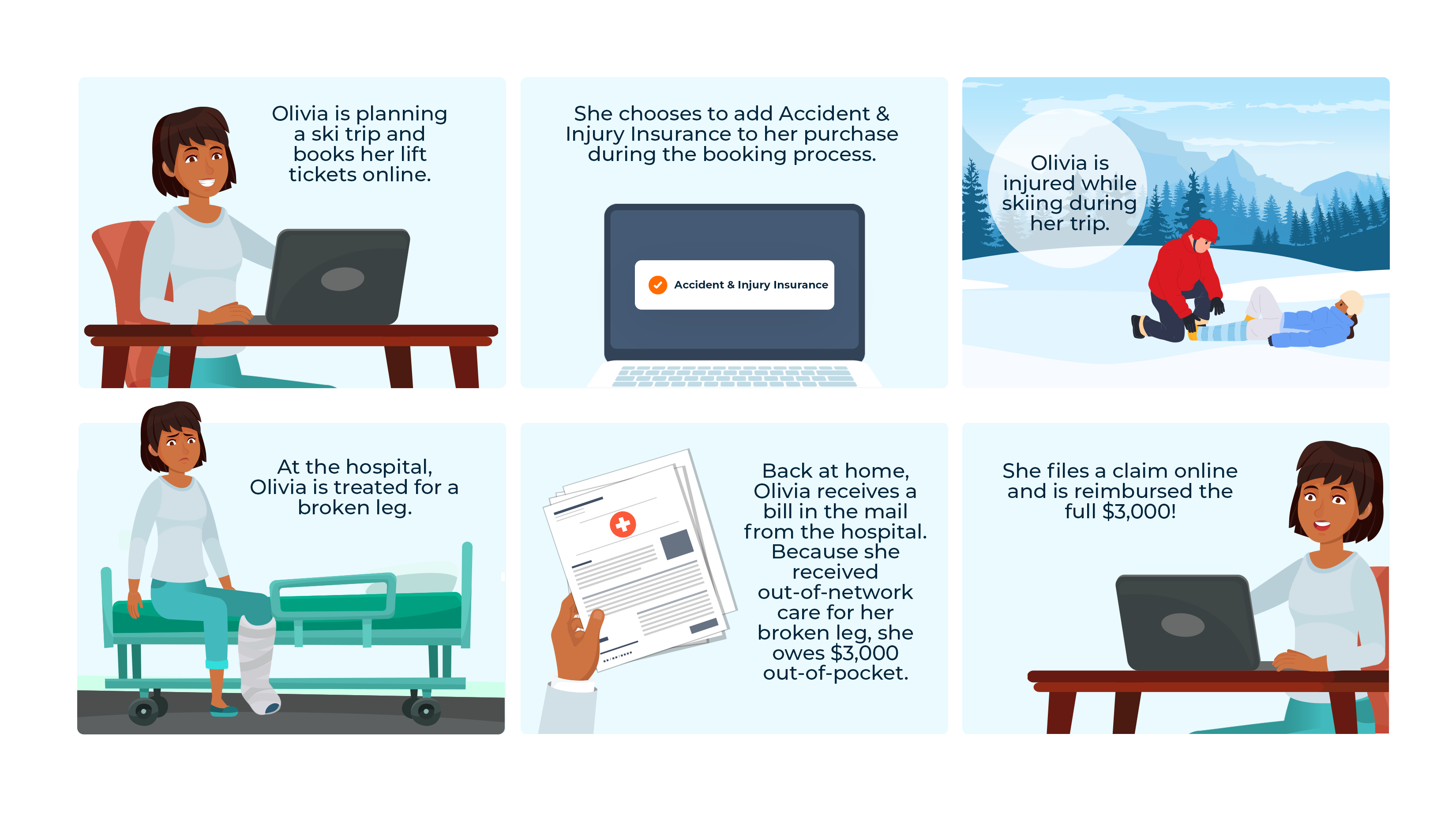

How it Works

Frequently Asked Questions

I have health insurance, why should I consider Accident & Injury Insurance?

Accident & Injury Insurance is supplemental coverage that covers what your health insurance plan might not. For example, Accident & Injury Insurance can be used towards your deductible to cover your out-of-pocket expenses if the injury occurs during the covered activity.

Is this a one-time fee? Or a monthly payment?

Accident & Injury Insurance is a one-time fee that covers the duration of your registered activity. You can purchase a single or multi-day policy. If you would like to cover another activity, you will have to purchase an additional policy for that activity.

How does it work?

Accident & Injury Insurance reimburses you directly for medical expenses that you paid out-of-pocket. In order to receive a reimbursement, you must first file a claim in our Customer Portal with supporting documentation.

How do I file a claim?

After purchase, you can create a free account in our Customer Portal. The portal will display a full list of your active policies and links to begin the claims process. Click here for instructions on how to create an account.

Which do I need to file a claim?

To file a claim, you’ll need to confirm your identity and provide basic information about your accident in addition to medical receipts and documents. If you have any questions, contact our support team at support@vicoverage.com.

Where can I find my policy ID?

The customer portal contains all policy information, including your policy ID. After purchasing a policy, you will also receive an email from ViCoverage which includes the policy ID. Please search your inbox for “ViCoverage” or check your spam folders for the email. If you’re still unable to find your policy ID, please send a request to support@vicoverage.com.

How long do I have to file a claim?

You must begin the claims process within 30 days after the injury occurs. If you don’t have your medical receipts or other documentation yet, you can begin the claims process by filling out the claims form in the Customer Portal without uploading documents and upload your documents once you receive them.

How are claims handled and when will I receive an answer?

Claims are promptly acknowledged and assigned to a claims examiner. The actual time to resolve a claim depends upon its complexity and the level of documentation required. Any questions about your policy, coverage, or a submitted claim can be directed to the ViCoverage customer support team at support@vicoverage.com.

Can I cancel my policy?

If you are not satisfied with the product for any reason, you have the option to cancel your policy within ten (10) days of the initial purchase date – as long as you have not filed a claim. To cancel your policy, please contact us at support@vicoverage.com.