Be prepared when accidents happen.

Extra coverage for high deductibles.

The average deductible for employer-provided health insurance is $2,700, with high-deductible plans averaging about $4,500. Accident Medical Insurance has no deductible, reimbursing up to $5,000 to cover out-of-pocket-costs for medical bills resulting from an injury during a practice or game.

A Sports Injury Without Accident Insurance:

Total bill for an ER Visit before insurance:

$6,000

Primary Health Insurance plan covers:

$2,800 (80% of total bill after the $2,500 deductible)

Final bill after insurance:

$2,500 deductible + $700 coinsurance

You pay out-of-pocket:

$3,200

A Sports Injury With Accident Insurance:

Total bill for an ER Visit before insurance:

$6,000

Primary Health Insurance plan covers:

$2,800 (80% of total bill after the $2,500 deductible)

Accident Insurance covers:

$2,500 deductible + $700 coinsurance

You pay out-of-pocket:

$0

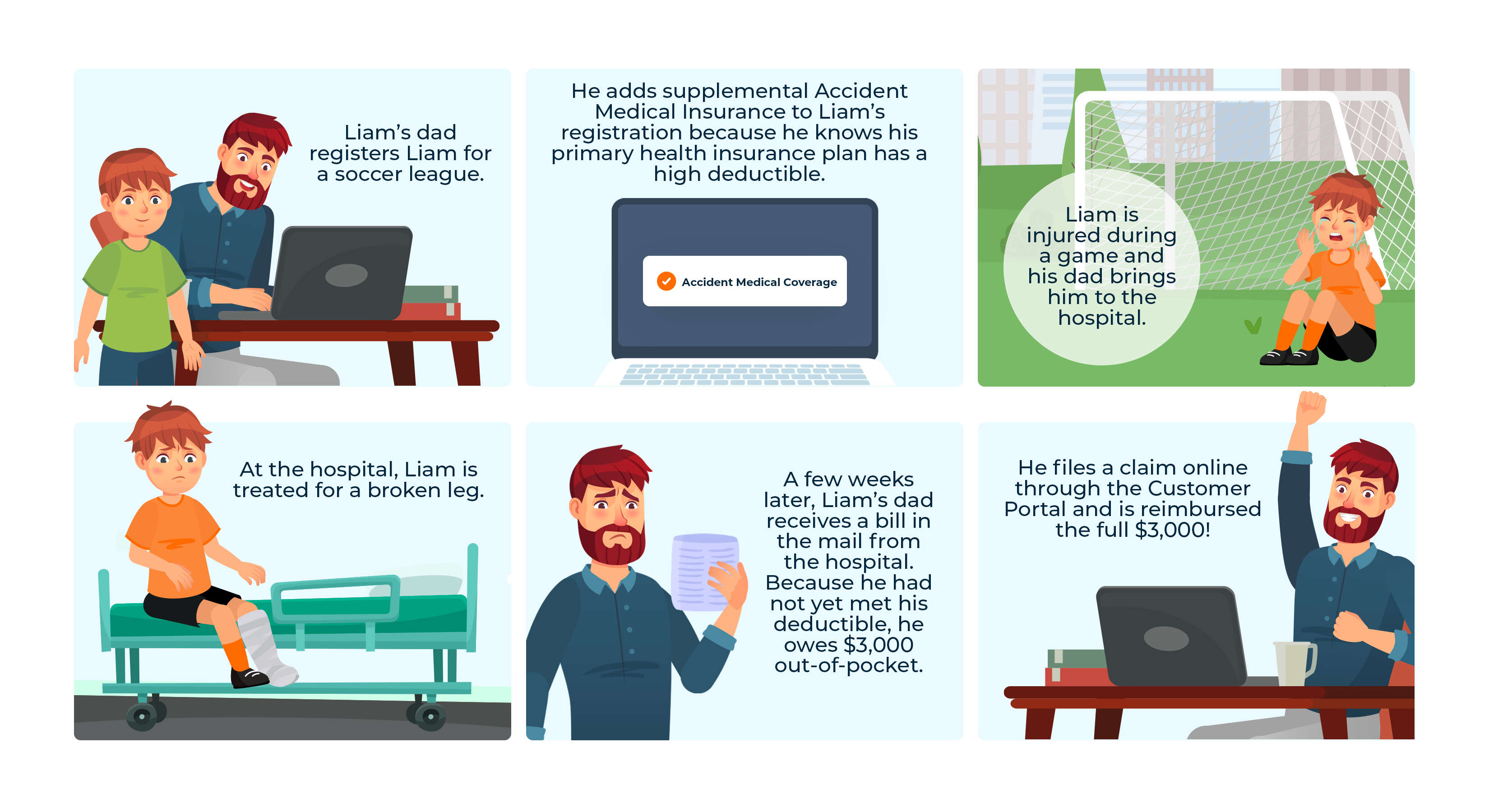

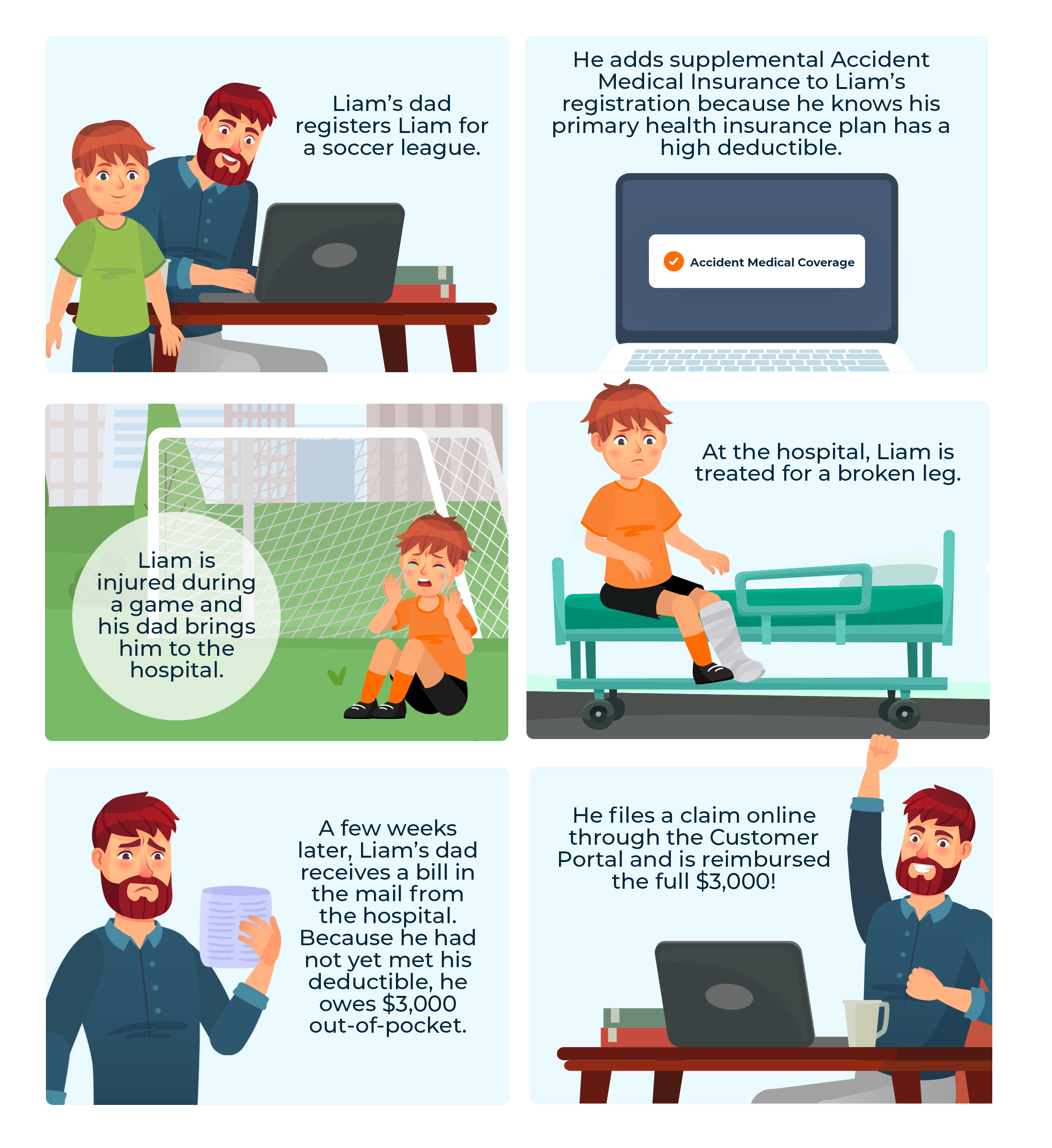

How It Works

Frequently Asked Questions

I have health insurance, why should I consider Accident Insurance?

Accident Insurance is supplemental coverage that covers what your health insurance plan might not. For example, Accident Insurance can be used towards your deductible to cover your out-of-pocket expenses if the injury occurs during the covered activity.

Is this a one-time fee? Or a monthly payment?

Accident Insurance is a one-time fee that covers the duration of your registered activity. If you would like to cover another activity, you will have to purchase an additional policy for that activity.

How long am I covered?

Coverage starts the day of the registered program’s first activity and ends on the last day of the activity. Any injuries that occur during an official game or practice are included (injuries sustained outside of the official program are not covered).

How does it work?

Accident Insurance reimburses you directly for medical expenses that you paid out-of-pocket. In order to receive a reimbursement, you must first file a claim in our Customer Portal with supporting documentation.

How do I file a claim?

After purchase, you can create a free account in our Customer Portal. The portal will display a full. list of your active policies and links to begin the claims process. Click here for instructions on how to create an account.

Which documents do I need to file a claim?

You will need the following documents to file a claim: Proof of participation (a copy of the roster or a document from the team), documentation of the injury incident (a note from the coach or program admin confirming the date of the accident), medical receipts (proof of out-of-pocket expenses related to the participant and the injury).

How long do I have to file a claim?

You must begin the claims process within 30 days after the injury occurs. If you don’t have your medical receipts or other documentation yet, you can begin the claims process by filling out the claims form in the Customer Portal without uploading documents and upload your documents once you receive them.

How are claims handled and when will I receive an answer?

All claims are handled by Conifer Insurance Company. If you have provided proper documentation, you can expect a resolution and payout typically within 5-7 business days.

Can I cancel my policy?

If you are not satisfied with the product for any reason, you have the option to cancel your policy within ten (10) days of the initial purchase date – as long as you have not filed a claim. To cancel your policy, please contact us at support@vicoverage.com.